In this third part of the series I am looking at the nutrition marketing messages. Marketing messages are the terms, phrases, emotions and general tools that marketers use to manipulate you.

Previously we’ve looked at the major players and a typical shelf and also what ingredients they list on the packaging. In future articles we’ll talk about price and other influence tactics.

For this analysis I recorded all the non-ingredient messages on the front of containers from a shelf at my local supermarket. I then divided these up into categories that seemed to share similar characteristics.

These groupings are:

- Proprietary terms

- Comfort words

- Precious metals and gems

- Quality indicators

- Advanced terms

- Positive plus and pro

- Nutrition related

- Science / authority

- Learning

- Value

- Natural

- Place of origin

- New

- Convenience

- Religion

- Claims and,

- Other comments.

As you can see there’s no shortage of nutrition marketing messages that companies can use. In the remainder of the article I’ll:

- Describe each category

- Provide examples, and then

- Give some analysis on which companies and brands are packing in the most nutritional marketing messages.

Proprietary Terms

The big brands have all worked hard to come up with terms that are pseudo-nutritional / scientific. These proprietary terms can’t be used by other brands because they are registered or trademarked. If you can get consumers using the language of your product then it’s a lock to keep that consumer. Time for some examples.

Nestle Wyeth S-26: There were two prominent terms in ‘Nutri S-26 System’ and ‘Biofactors System’. Their website also promotes the ‘Nutrilearn System‘. Based on putting these terms into a search engine I would say the marketing team have done a poor job of linking their brand. It’s not consistent and not easy to find.

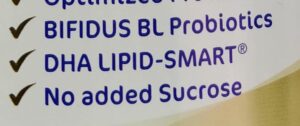

Nestle NAN: Have the DHA LIPID SMART trademark and I also give them a “fail” on search engine optimisation. Nothing prominent appears on my first page of results other than links on where to purchase the product. To add insult to injury Danone Nutricia Aptamil has taken an advertisement at the top of the search results.

Abbott: Will get partial marks for EyeQ Plus and a “fail” on IMMUNIFY as it wasn’t linked to Abbott at all from search results. Searching for EyeQ alone brings up a range of optometrists and tech startups.

RB Mead Johnson: We have our first success story with Enfamil’s Gentlease. Gentlease appeared right at the top of search results as well as being a combination of two emotionally loaded terms and describing the category of partially hydrolysed proteins.

Danone Dumex: Also do well with PreciNutri+ with the term appearing at the top with and without the + symbol. It brings an emotional term (precious) and nutritional term together and then they link that to a scientific authority message around their patented pre-biotic blend.

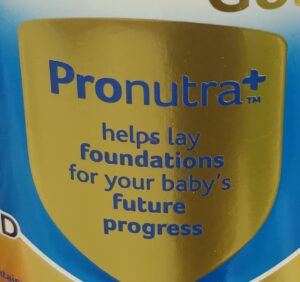

Danone Nutricia: Have the ProNutra+ proprietary term. Based on Google searches my feelings are mixed. A Hong Kong website appears near the top and two drug-related links above it make it sound serious. The website is not well designed and conflicts with the New Zealand branding on the packaging with German branding on the web page.

Friesland: Do well with the LockNutri trademark. The term appears right at the top of the search results and clearly links to what parents would want to know. Friesland pushes the “essential amino acid (lysine)” as the essential natural nutrition. It’s interesting that the ingredient doesn’t get mentioned on the packaging.

Comfort Words

These words and logos make you feel like the caring parent that you are. We all want a foundation for our strong junior adventurer creating the building blocks for future progress and first steps!

Every company gets on board here:

| Company | Comfort Words |

| Nestle Wyeth S-26 | Promise, Strong, Foundation |

| Nestle NAN | Foundation for Life |

| Abbott | Tummi Care, Comfort / Total Comfort, Gain |

| RB Mead Johnson | Unleash, Important Building Blocks, Gentle(ase), 360 Degrees |

| Danone Dumex | Adventurer, Preci(ous), Junior, Heart |

| Danone Nutricia | Foundations, Future Progress, Building Blocks |

| Friesland | First Steps, Young Explorer, Bright Star |

| Fair Price | Junior |

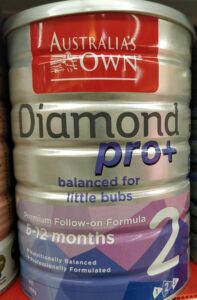

| Australia’s Own | Little Bubs |

Precious Metals & Gems

There was so much gold that it was almost shocking to get Australia’s Own Diamond Pro+ Silver packaging!

Making up for the lack of gold with another precious metal and a precious gem was a nice touch so that they didn’t get left behind.

Also bonus marks for Bellamy’s (at another store) for almost going without gold except for the word organic. At least it was small.

Quality Indicators

For sure there is a lack of creativity in marketing teams these days with Premium. Super premium anyone?

| Company | Quality Indicator |

| Nestle NAN | Premium |

| Abbott | Super Premium, Unique |

| RB Mead Johnson | Super Premium |

| Australia’s Own | Premium |

Advanced

Similarly, the thesaurus did not get a working over for Advanced. Abbott would also struggle to prove the ‘most advanced’ moniker.

| Company | Advanced |

| Nestle Wyeth S-26 | Advanced Formula |

| Abbott | Most Advanced |

| RB Mead Johnson | Advanced Formula |

Positive, Plus and Pro

As you may have gathered from the pictures so far there is a healthy reliance on + symbols and the usage of the term pro. It’s also possible to reinforce just how positive a product is by using the letters within the symbol.

| Company | Positive Term |

| Nestle Wyeth S-26 | Pro(mil) |

| Nestle NAN | (Opti)Pro |

| Abbott | Intelli-Pro, EyeQ Plus |

| RB Mead Johnson | A+, Plus + |

| Danone Dumex | Nutri+ |

| Danone Nutricia | Pronutra+ |

| Australia’s Own | Pro, Plus + |

Nutrition Messages

As I discussed in the last article (Nutritional Ingredients in Infant Formula) nutrition forms the key marketing messages that companies are using to communicate. To support the ingredients there are also other nutrition-related words used to enhance the message. Some of these are real words and others fall back to the proprietary terms.

| Company | Nutrition Term |

| Nestle Wyeth S-26 | Nutritional, Nutri S-26 System |

| Nestle NAN | Optimized Proteins, Nutritional |

| Abbott | Higher In |

| RB Mead Johnson | Amount of Ingredients, Unique Blend |

| Danone Dumex | Nutri+ |

| Danone Nutricia | Pronutra+ |

| Friesland | LockNutri |

| Australia’s Own | Nutritionally Balanced |

Science / Authority

This category of nutrition marketing messages is designed to show that they have invested significantly in the research and development of their products or that they are somehow approved by other bodies.

| Company | Science / Authority Term |

| Nestle Wyeth S-26 | Formulated |

| RB Mead Johnson | Eye & Brain Development / Brain & Eye Development Scientifically Formulated Meet Recommended Daily FAO / WHO Recommends Report of an expert consultation. |

| Danone Dumex | Patented .. Blend Recommended for… Medical Supervision 100% Batch Tests |

| Danone Nutricia | Meet Recommendations Expert in Early Life Nutrition |

| FairPrice | Specially Formulated / Formulated Formulated Supplementary |

| Australia’s Own | Strong Bones & Teeth Tailored Professionally Formulated Immune System Function |

Learning

Every parent wants their child to grow up smart and successful. There’s no surprise that companies play on that concern with their messages for intelligence, education learning and cognition.

| Company | Learning Term |

| Nestle Wyeth S-26 | Let Kids Learn in Multiple Ways |

| Abbott | Intelli-Pro |

| RB Mead Johnson | Learning Potential Overall Mental Functioning |

| Danone Dumex | Education (Picture) |

| FairPrice | Education |

| Australia’s Own | Normal Cognitive Function |

Value

As discussed in part one of this series and to be explored further in later posts, cost and value aren’t always at the top of parents concerns. This is reflected in this category of nutrition marketing messages where cost, value and savings are not commonly stressed.

| Company | Value Term |

| Nestle Wyeth S-26 | Twin Pack |

| Abbott | Save More |

| RB Mead Johnson | Free Amount of Ingredients |

| Danone Dumex | $30 Off |

| Danone Nutricia | Member Exclusive |

Natural

There’s a growing push, particularly among the niche players, for organic and natural ingredients.

I’d not included Bellamy’s in this series of articles because they hadn’t made it to the main shelf of the supermarket I analysed but they are clearly leading this category with organic mentioned four times on the front of their packaging. I expect the big players to start to work on the organic category in the near future.

| Company | Natural Term |

| Abbott | Natural Vitamins |

| RB Mead Johnson | Natural Defenses |

| Bellamy’s | Organic Certified Organic Made from nature |

Place of Origin

Turns out there are a few countries in the world that are seen as having healthy, trusted and premium foods. From a country basis, it’s a pretty short list with Australia, New Zealand, The Netherlands and USA all getting claimed as home locations. The European Union also gets a special mention. Despite being in Asia the only local brand in FairPrice is keen to highlight that it is made outside the country, a trend in food origin that is pretty common in Asia.

| Company | Place of Origin Claim |

| Abbott | Made in Europe + EU Stars |

| Danone Dumex | USA Soy Protein Isolate |

| Danone Nutricia | Imported from New Zealand New Zealand Flag |

| Friesland | Produced in the Netherlands |

| FairPrice | Australian Made |

| Australia’s Own | Australia’s Own |

New

We’re constantly told that the world is speeding up and changing faster than ever. You’d expected the same of infant nutrition so it’s not a surprise to see marketing claims around new and improved. I haven’t checked out the veracity of these claims.

| Company | New Term |

| Abbott | New Improved |

| RB Mead Johnson | New Formula |

| Danone Dumex | New and Improved |

| Friesland | Improved Formula |

Convenience

We’re down to the niche categories now and convenience had only one player in Abbott. They mention “travel pack” on their branding. Given how many mums are travelling and feeding it was a surprise that this wasn’t considered by other companies. The likely answer is that mums are buying in bulk and already have solutions for the travelling conundrum.

Religion

This one was a surprise given we were in Singapore but RB Mead Johnson was the only company to put the halal food stamp on the front of their products. In Australia this might be contentious but I expected to see it on many of the products.

Claims

The final niche category with only a single entrant was making a claim against the competition. It was RB Mead Johnson again with “#1 BRAND (Children Nutrition Milk Formula) IN THE WORLD.” It’s not a bad claim to fame.

Analysis

When I started this article I was expecting to see some real differentiation among the brands but this wasn’t really the case. What was most noticeable were brands who wanted to pack a lot on the package and those who were more selective.

To rank this I looked at which brands had at least one term in a category and then the overall number of unique terms. My ranking is below.

| Unique Category + Unique Terms = Rank | Company |

| 16 + 26 = 42 | |

| 15 + 21 = 36 | |

| 10 + 16 = 26 | |

| 10 + 14 = 24 | |

| 09 + 13 = 22 | |

| 09 + 13 = 22 | |

| 07 + 09 = 16 | |

| 07 + 08 = 15 | |

| 06 + 07 = 13 |

So do you pay more per marketing term?

Part 1: Nutrition (Infant, Dairy, Maternal and Adult) : Singapore Analysis

Part 2: Nutritional Ingredients in Infant Formula

Part 4: Infant Nutrition Price Analysis

2 thoughts on “Infant Nutrition Marketing Messages”