We (Veeva Systems) have a number of nutrition companies as customers. It’s an interesting crossover to the life sciences industry as they are doing R&D around the science based aspects and infant nutrition has some compliance restrictions that limit what marketing is allowed. For example Singapore is barring the use of “sponsorships” (non-monetary incentives) to hospitals for preferential brand placement (January 2019) and increasing the limitations from targeting 0-6 month olds to 0-12 months of age. There’s also a push by health authorities to promote more breast feeding including prohibiting nutrition and health claims on formula milk. Despite the moves infant nutrition will stay due to the ease of use and priority that mothers place on their babies on top of special dietary restrictions.

Other factors that have infant nutrition in the news are increasing prices (a big issue in 2017), the demand from China for branded products from regulated overseas markets and now decreasing prices as mothers return to breastfeeding after government health campaigns.

During my most recent visit to the supermarket I spent some time checking out the shelves and the various promotional material. You can see the main infant nutrition shelf below.

The Nutrition Players

So are who are the main players in the nutrition industry and what do they offer?

Abbott (Nutrition) – Are part of the broader Abbott group comprising Established Pharmaceuticals (EPD), Medical Devices and Diagnostics and Diabetes Care.

Promote themselves as the #1 world leader for adult medical nutrition (USD$3B revenue in 2018) but much of their revenue comes from the infant sector where they also see themselves as the #1 in pediatric nutrition in the United States and a number of other international markets. (USD$4B revenue in 2018.) There’s also some interesting material related to the codes of conduct from the 2018 BMS Company Scorecard.

Products Identified: Similac, Isomil,PediaSure, Grow, Glucerna, Ensure

Danone – Was identified under a number of sub-brands in Dumex and Nutricia with their own branding much less prominent. They are probably better know for their water brands including evian but I’ll focus here on the Essential Dairy and Plant Based Products (EDP).

They key messages from their annual report are primarily around health and sustainability but also list themselves as #1 world wide in fresh dairy products, #1 in Europe for Advanced Medical Nutrition and #2 worldwide for early life nutrition. Total sales was USD$7.1B but this also includes baby foods.

Products Identified:

Dumex: Mamil, Dupri, Dugrow, Mamil Mama

Nutricia: Aptamil, Fortisip

Renckitt Benckiser (Mead Johnson & Company LLC) – Is better known for their wide range of consumer products (Mortein, Dettol, Durex, Harpic, Finish, Veet, Strepsils) but entered into the medical nutrition space with their purchase of Mead Johnson Nutrition in 2017. The company has split into two divisions of Hygiene and Health.

According to the 2018 annual report infant and child nutrition business is around USD$3.2B. The focus has been on business turnaround and integration but there are few key messages.

Products Identified: Enfamil, Enfagrow

Nestle – Like other companies are better known for their more consumer focused products. (Ice cream, milo, chocolates, nescafe, maggi noodles.) The company splits into quite a few divisions with Powdered and Liquid Beverages, Nutrition and Health Science, Milk Products and Ice Cream, PetCare, Prepared dishes and cooking aids, Confectionery, and Water.

The Nutrition and Health Science part of the business is our focus and makes up USD$16.5B according to their 2018 Annual Report but this also includes baby foods. The segment will continue to be a focus with Nestle’s strategy of health and sustainability. There’s also plenty of room to grow in the greater Asia region with only China (#2), Philippines (#8), Japan (#11), Australia (#14), and India (#15) in their top 16 markets across all segments.

Nestle’s products also include the Wyeth Nutrition brand name which was purchased from Pfizer in 2012.

Products Identified:

Nestle: NAN Optipro, Lactogen, Omega Plus, Nespray, Every Day, Nutren Diabetes, Cerelac

Wyeth: S-26 Gold, Enercal Plus, Promama

FrieslandCampina – Is a Dutch dairy cooperative that operates in a small number of markets. The core of the business is consumer dairy, specialised nutrition (our focus), ingredients (including selling to other companies in this article), and dairy essentials (cheese brands, butter and milk powder). Revenue was down considerably in 2018 and the company went through a board change.

There’s a little bit of a focus on the Asia region with some brands only found here including Frisian Flag (Indonesia), Dutch Lady (Asia), Alaska (Philippines), and Foremost (Thailand).

According to the 2018 Annual Report FreislandCampina’s business in specialised nutrition was USD$1.4B.

Products Identified: Friso, Frisolac

Bellamy’s – is an Australian milk producer and parent company of Bellamy’s Organic which is the infant nutrition arm. They claim to be the #1 organic infant formula producer. A board spill in 2017 related to mismanagement of the company was a big stumbling block and there are still doubts on if they can successfully sell into the Chinese market.

The 2018 Annual Report highlights that the company is still playing catch up with some of the more “scientific” ingredients that their competitors are already including. They’re also increasing the amount of Australia product (rather than European) and pitching on their organic marketing.

Products Identified: Bellamy’s Organic

Fonterra – New Zealand’s largest dairy company and biggest company overall. They are responsible for around 30% of dairy products globally and run as a dairy cooperative. They supply a number of the companies higher up in this list but have a lower focus on the marketing of products or R&D for production on medical nutrition products. Concerningly for the industry they posted a loss in their 2018 annual report although this was partially due to one off costs. For this analysis it’s of interest that they are launching a dedicated medical nutrition division although at this point it doesn’t target mothers and infants.

Products Identified: Anlene, Fernleaf, Anmum

Australia’s Own / AO Diamond Nutrition / Freedom Food Group – is an Australian consumer food company with a focus on healthier choices. The major brand for infant nutrition is Australia’s Own.

The 2018 Financial Results Company Presentation shows that nutritionals only makes up 4% of their AUD$350m business making them a relatively small player. China and South East Asia are certainly seen as growth areas over the next few years.

Products Identified: Diamond Pro+

MarinEx Pharmaceuticals – is a Singapore based company that’s creating a milk product based on New Zealand dairy ingredients and then adding marine ingredients for the local market. Particularly they are looking at collagen additives. There are a small number of partner distributors in Hong Kong, Malaysia, Philippines and Sri Lanka.

Products Identified: Osteo Milk

Orient Europharma – a Taiwanese company that also does medicines and “anti-aging” products on top of their nutriceuticals. Has affiliates in Singapore, Hong Kong, Malaysia, The Philippines, and mainland China. Focus is on their goat milk products and milk sourced from New Zealand.

Products Identified: Karihome

Nature One Dairy – an Australian company with a focus on medical grade milk products. They sell under both their own brand names and to other companies. They also have offices in Shanghai and Singapore as they look to target the Asia market.

No annual report was found.

Products Identified: Organic, Fortiplus

FairPrice – Singapore’s largest supermarket network which operates under a number of brand names including FairPrice Finest, FairPrice Express, FairPrice Xtra, Cheers and Unity Pharmacy.

Like many supermarket chains they’ve capitalised on their own brand name to release essentially generic products against branded items. For infant formula this launched in 2017 amid government concerns around infant formula prices.

Products Identified: Gold

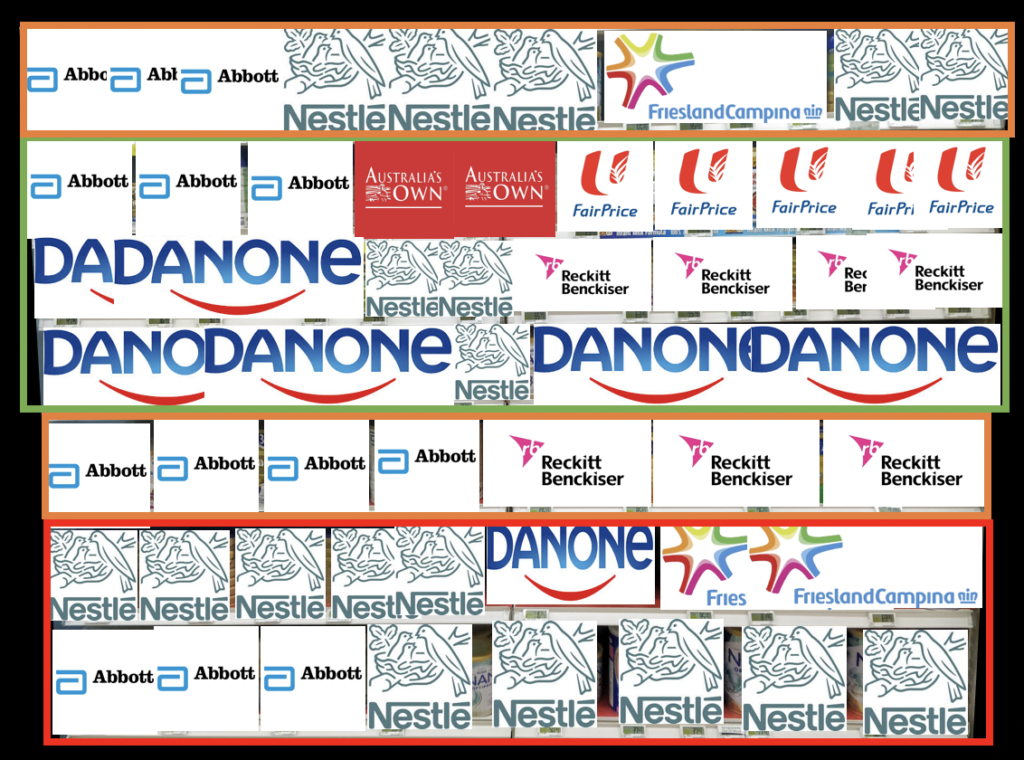

Infant Nutrition Shelf Space Analysis

Companies are very aware that that placement of their products on the self has a material impact on the on sales. This is no exception for infant formula although maybe lessened by the strong brand affiliation that mothers develop towards the first brand that is well received by their child.

There are two key metrics that companies will be looking at:

- Product placement at eye level – will your customers be able to see your product easily.

- Percentage of shelf allocation – will your product take up the most vision once the right shelf is found.

Here’s how the same shelf looks when I overlay the product placement grid:

Priority Zone:

Top Row: Similac (Abbott), Diamond Pro+ (Australia’s Own), Gold (FairPrice)

Middle Row: Mamil (Danone), S-26 (Nestle), Enfamil, Enfagrow (RB)

Bottom Row: Mamil (Danone), NAN Optipro (Nestle), Aptamil (Danone)

Border Zone:

Top Row: Similac, Isomil (Abbott), NAN Optipro (Nestle), Friso (Friesland), S-26 (Nestle)

Bottom Row: Similac (Abbott), Enfamil, Enfagrow (RB)

Searching Zone:

Top Row: S-26 (Nestle), Mamil (Danone), Friso (Friesland)

End of the World: Similac (Abbott), NAN Optipro, Lactogen, Lactogrow (Nestle)

Shelf Space Results

Danone is taking up a huge amount of the priority space. If you push the small amount of Nestle product out they almost reach 50% across their two brands.

Abbott and RB are present in the priority area but not with a huge amount. You’ll see the brand and be able to find it elsewhere in different packaging sizes and you’ll note that Abbott tries to take up as much of the left side of the shelf as possible. RB is taking the right but taking much less overall shelf space.

Nestle takes up a small amount in the very center. It’s a niche placement but they are almost drowned out. They make up for it with some placement in the border zone and a large chunk on the bottom shelves.

Australia’s Own gets some great placement for the size of their brand and I find their packaging stands out against the gold of so many of the other brands.

FairPrice have bumped up their own brand to the priority space which generally means they’d be making a fairly healthy margin on it. Being represented on the one row only means that they could get lost particularly as they’ve taken on the gold branding.

Friesland are on the edges here and may struggle to get recognised.

The other companies? Not located in this main shelf space so are off to the left on a much more crowded and diverse shelf.

Here’s another view where I’ve covered the space with the company logos.

Promotions

The other thing I found interesting was around special promotions and leave behinds (this is what we can a piece of paper that you can pick up and take home with you.

Here’s the promotion display from Danone / Nutricia / Aptamil which was targeting the toddler – 3 year old age group.

The code of conduct for the industry says that companies won’t make claims around the 0-2 year old age groups that formula is any way comparable to breast milk. That requirement is relaxed above those age groups and while common cows milk and a balanced diet is considered more than enough companies have broadened out into the adjacent age groups as a way of proving adjacent marketing. You know that after reading these claims you are going to apply them to Aptamil formula targeting young infants.

The claims from this pamphlet and how they relate to the science used across the industry will have to wait till the next article though as it’s another big topic.

The third area I’ll talk about are the other marketing, promotion and distribution channels and how that is changing across Asia.

If you’ve found this useful then please leave a comment below!

For further posts in this series

Part 2: Nutritional Ingredients in Infant Formula

Part 3: Nutrition Marketing Messages

Part 4: Infant Nutrition Price Analysis

3 thoughts on “Nutrition (Infant, Dairy, Maternal and Adult) : Singapore Analysis”